Orin v1.3.1 is defining a new AI Agent architecture for Fintech supporting different foundation models.

Our Fintech AI Agents can now perform cascaded tasks using multiple underlying foundation models.

Delivering the best in performance, agentic actions, and execution costs.

Backdrop:

A common challenge many Fintech teams face is keeping up with rapidly emerging AI models and effectively applying them to financial use cases.

As a Silicon Valley Fintech startup, our team also went through this. Despite having a technical background, it took us some time to understand new foundational AI models, recognize their strengths, and build a few standard Fintech workflows.

Initial results look promising—Fintech AI Agents can now perform cascaded tasks using multiple underlying foundational models.

A few highlights:

Deepseek R1

We tried the open-source Deepseek R1 foundational models, hosting them locally in our environment. Specifically, we used the r1:8b model and created a few application-level AI agents from it.

Answer Quality:

Deepseek performs well in logical reasoning, making it ideal for B2C Fintech cases where thousands of customer scenarios need to be mapped to a few standard supported cases.

It explains the logical details behind AI responses, which helps fine-tune AI agents and debug them for better answers.

Using the distilled model is resource-efficient but has limited reasoning abilities. However, the full model can provide:

Multi-step problem-solving

Better reasoning

Self-verification capabilities

Execution Speed:

We got pretty decent speed for our AI agent. We ran Deepseek R1 on a general-purpose EC2 instance (T3a), though it's not optimal for Gen AI training and inference.Running Cost:

It is free. We don’t have to worry about tokens during training and inference.

When deployed for application AI models, this can help us drastically reduce production and subscription costs.Data Security:

This is critical because B2B and Fintech use cases require strict customer data security and privacy.

Currently, our team uses OpenAI for Fintech AI agents, but anything involving Deepseek for customer deployment will need to be scrutinized for SOC2 and data compliance standards.

For more details on Deepseek setup and outcome, check out →

Comparing Deepseek R1 vs. OpenAI for Fintech use cases

Claude Sonnet 3.5

Many Fintech teams and customers have been asking us about Claude.

This model excels in data security and privacy and can execute stepwise actions—both critical aspects for financial companies and regulatory compliance.

OpenAI GPT-4o

This is the model we currently use for our Fintech AI Agents and customer applications.

So far, we’ve seen solid results in answer quality, deployment, and tuning. However, it is more expensive since it runs on token-based pricing.

AI Agents engage with Fintech customers in three modes:

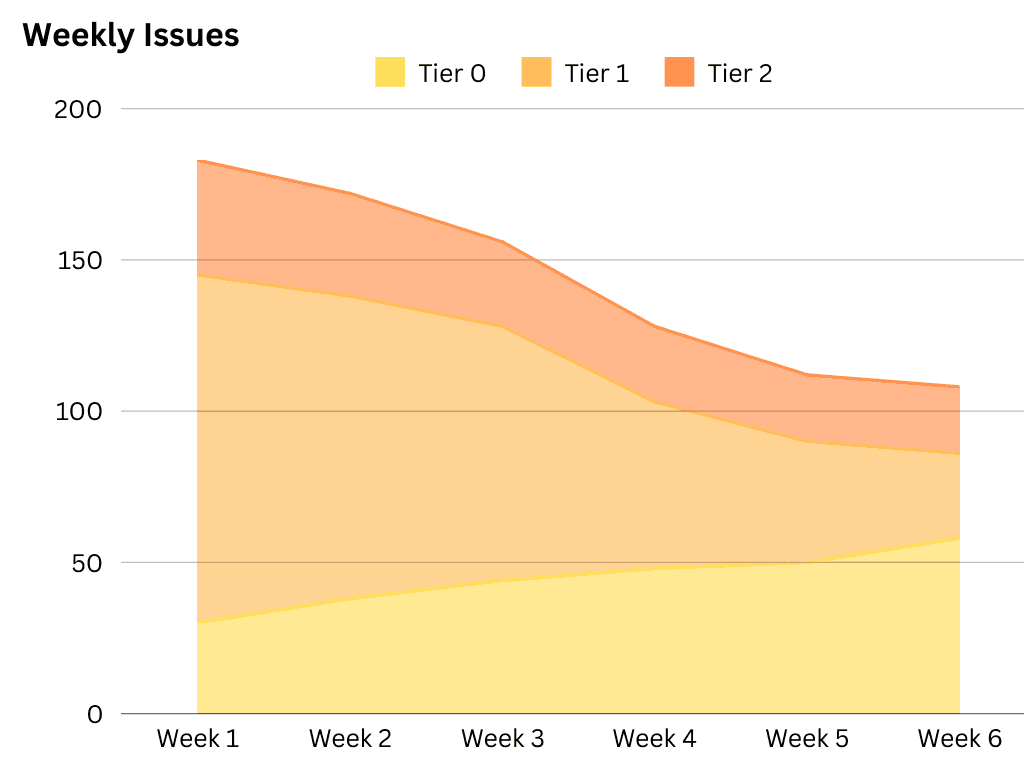

1️⃣ User chat – Embedded in customer portals and help center sites. Answers product questions and resolves Tier-0 issues.

2️⃣ Email queries – Parses email threads to understand customer problems, looks up different sources, reasons out a solution, and drafts responses. Used by human agents to efficiently reply to customers.

3️⃣ Ticket forms – Assists human agents by analyzing support tickets, using macros, knowledge bases, and past history to suggest responses for customer reps handling the issue.

Top Fintech customer use cases:

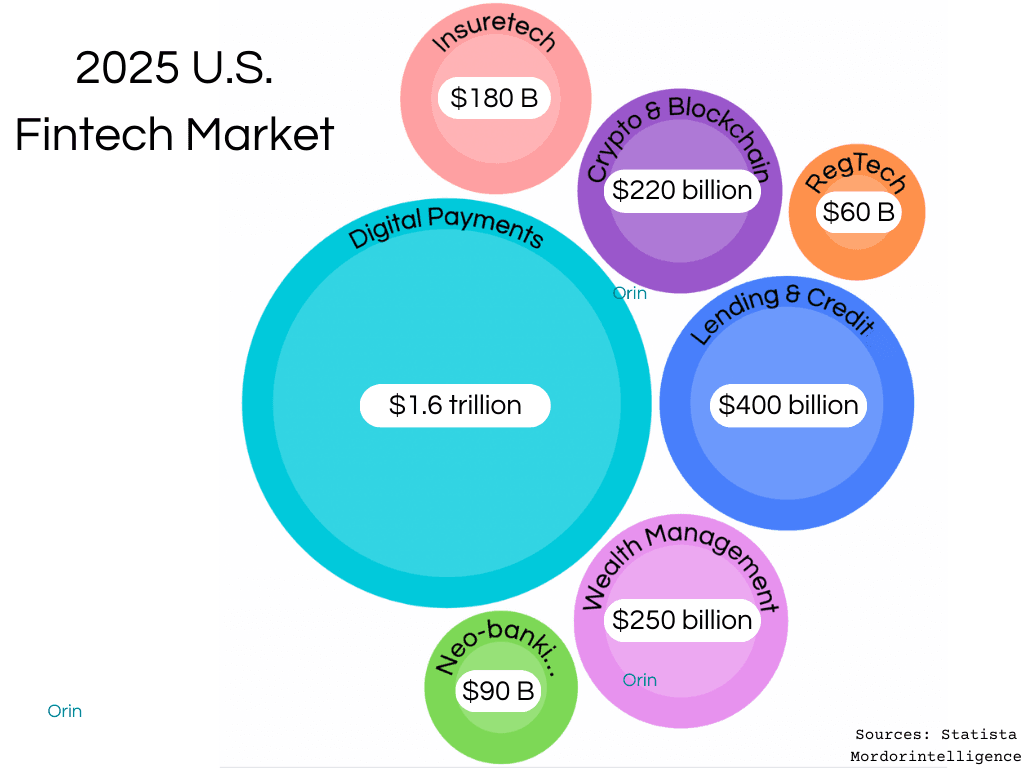

🔸Digital Payment Apps –

Payments is a vast topic in Fintech, covering many transaction types, geographies, and payment methods.

AI Agents are ideal for handling a variety of user inquiries on rates, transaction times, and currency exchange.

We’re seeing solid response quality and high deflection rates from AI Agents.

🔸 Wealth Management & Tax Accounting –

This involves dealing with a large, standardized document corpus, including IRS tax codes, forms, and investment guidelines.

This makes it an ideal use case for AI Agents to automatically look up and prepare answers to customer questions.

Our AI agent currently manages queries about IRS forms, tax limits, 401(k), and IRA options across a variety of tax accounting and investment products.

Conclusion

This is still the beginning — defining new business applications, AI Agents, and architectures using foundational models. Stay tuned as we explore more in this evolving space.

An example AI Agent looks like this inside the customer portal.

Article by

Harish Maiya

Co-Founder

Published on

Jan 31, 2025