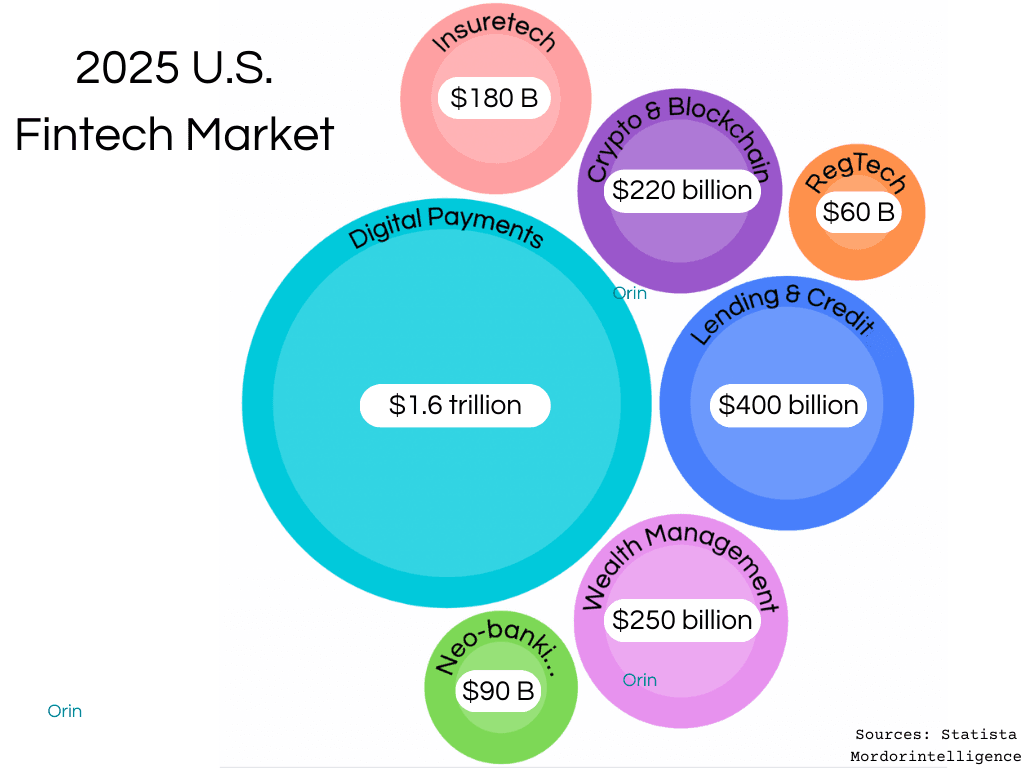

The U.S. fintech market is set to witness solid growth in 2025, with segments like Digital Payments & Wallets, Lending/Credits, and Crypto Blockchain leading the charge.

Total market value is expected to surpass $2.6 trillion, driven by innovative technologies and shifting consumer demands, per recent data from Mordor Intelligence and Statista.

Let’s dive into the key trends shaping the fintech industry. How leading Fintech companies are giving great customer experiences in these verticals.

1. Stablecoins – A Bridge to Digital Finance

As the popularity of stablecoins continues to rise, they are becoming a critical component of the U.S. Fintech ecosystem. These digital assets offer the stability of traditional currencies with the speed and transparency of blockchain technology, making them ideal for international transactions and remittances.

Market Size and Adoption

Total stablecoin supply is projected to double, exceeding $400 billion by the end of 2025.

Daily settlement volumes for stablecoins are expected to reach $300 billion, equivalent to 5% of current DTCC volumes.

The stablecoin market capitalization is forecast to expand 2.5 times through 2025, driven by business-to-business payments and cross-border transactions.

Regulatory Landscape

Stablecoin legislation is predicted to pass both houses of U.S. Congress and be signed by the President in 2025, providing regulatory clarity.

This increased clarity is expected to lead to an explosion in stablecoin supply and adoption.

Comprehensive market structure legislation for the broader crypto market is not expected to be completed in 2025.

Market Dynamics

Tether (USDT) and USD Coin (USDC) are expected to maintain their dominant positions, though new entrants like rUSD and USDG may challenge their leadership.

Alternative stablecoin issuers could grow from 5% to 20% market share.

The growing number of USD-backed stablecoins is seen as supportive of dollar dominance and Treasury markets.

Use Cases and Integration

Stablecoins are increasingly finding product-market fit for payments, remittances, and settlements.

Traditional financial institutions (TradFi) are expected to issue their own stablecoins, further bridging the gap between traditional and digital finance.

Stablecoins will likely play a crucial role in tokenized securities, with the value of tokenized securities projected to surpass $50 billion.

Businesses adopting stablecoins find a need to operate at a global scale, handling queries about exchanges from local currencies to crypto and vice versa. AI support agents like Orin are instrumental in scaling operations, staying updated with current processes, and supporting multiple languages and time zones for easier customer experiences.

2. FedNow and RTP – Money Transfers Getting Faster

The launch of real-time payment (RTP) systems like FedNow is changing domestic money transfers. Consumers and businesses alike now demand instant, secure, and cost-effective payment solutions, a trend that is reshaping digital payments and banking services.

Key Changes

Increased Transaction Limits: The RTP network will raise its individual transaction limit to $10 million, effective February 9, 2025, making it more attractive for commercial use.

Adoption Growth: By 2025, FedNow is expected to reach around 8,000 out of 9,200 financial institutions using the Fed's services across the country.

Growth in Transaction Volume: As of October 2024, RTP was already processing 31.7 million transactions valued at $25.4 billion monthly, with year-over-year growth of 6.2% in volume and 9% in value.

Competitive Pricing: FedNow's transaction fee is set at $0.045 per transaction, paid by the sender.

This competitive pricing may drive further adoption and potentially influence RTP's pricing structure.

Expanded Use Cases

Instant movement of money between accounts

Government payments such as tax refunds and social security benefits

Business-to-business transactions

Bill payments

Assisting users with real-time payment queries and resolving issues instantly becomes critical for customers. Orin’s AI Reps ensure users have a seamless experience by providing round-the-clock customer support and transaction assistance. Platforms like Orin empower fintech companies to meet this demand efficiently.

3. Banking as a Service (BaaS) – Driving Neobanking Innovation

The U.S. Banking-as-a-Service (BaaS) and neobanking market is poised for significant growth and innovation in 2025.

Technological Integration

AI and automation are becoming central to BaaS and neobanking operations, enhancing personalization and efficiency.

Blockchain and cryptocurrency integration are expanding, offering new financial products and services.

Market Dynamics

Traditional banks are increasingly partnering with BaaS providers to stay competitive in the digital landscape.

Non-banking companies are leveraging BaaS to offer financial services, expanding the market.

Focus Areas

SME banking solutions are a key growth area for neobanks in 2025.

Sustainable finance and environmentally friendly banking products are gaining traction.

Increased regulatory clarity is expected, potentially accelerating BaaS and neobanking adoption.

Challenges and Opportunities

Intensifying competition among neobanks and traditional banks adopting BaaS models.

Opportunities for expansion through partnerships, acquisitions, and entry into new market segments.

Growing focus on personalization and customer-centric services, leveraging data analytics.

Orin’s AI solutions seamlessly integrate with BaaS platforms, enabling neobanks to scale rapidly while delivering consistent support. By automating repetitive tasks and ensuring compliance, Orin helps these banks focus on growth and customer satisfaction.

4. AI Agents – Redefining Fintech Services

Remember the Klarna use case? Deploying AI agents for every customer service function.

Expect more Fintech companies to adopt this strategy — whether as a full autopilot with AI Agents, a hybrid model, or a co-pilot to human reps.

Market Adoption and Impact

2025 is predicted to be the "year of AI agents" in fintech, with agents becoming integral to daily customer service operations.

AI agents are transforming areas like software development, customer support, and financial services by automating processes and improving accuracy.

Financial institutions are increasingly using AI to combat fraud, analyze unstructured data, and protect sensitive customer information.

Rapid Scaling and Operational Efficiency

AI agents would enable fintech companies to scale operations rapidly, handling thousands of customer interactions simultaneously.

Automation of repetitive tasks like payment inquiries, credit scoring, fraud detection, and regulatory compliance significantly reduces operational costs.

Integrated AI platforms optimize workflows across departments, creating more cohesive operations.

Consistent Customer Experience

AI-powered assistants provide personalized, 24/7 support, maintaining high-quality service standards.

These agents offer tailored financial tools, such as robo-advisors and adaptive asset management systems.

By 2025, AI will be deeply integrated into customer service, including natural voice capabilities.

Round-the-Clock & Multilingual Services

AI agents offer uninterrupted support, solving problems 24/7.

Advanced natural language processing enables these agents to assist in multiple languages, expanding global reach for fintech companies.

Product Suite and Regulatory Updates

AI agents autonomously manage payments, process transactions, and handle complex financial operations.

They continuously update their knowledge base with the latest product releases and regulatory documents, ensuring accurate and compliant service delivery.

Real-time data analysis allows for instant updates to product offerings and compliance measures.

AI agents like Orin are helping fintech companies offer top-notch service while keeping up with the fast-paced industry.

5. BNPL (Buy Now, Pay Later) – Going Strong

The BNPL market is still booming in 2025, as consumers continue to seek flexible financing options for their purchases. Fintech companies offering BNPL solutions are leveraging data-driven insights to better assess credit worthiness and improve customer acquisition.

Market Outlook

The U.S. BNPL market is projected to reach $97.3 billion in 2025, representing a 20.4% annual increase from 2024.

This significant growth is expected to continue, with the global BNPL market potentially reaching $450 billion by 2026.

Consumer Adoption

BNPL usage is expanding across generations, with 28.9% of Gen X consumers expected to use the payment method in 2025.

Millennials remain the largest user group, followed by Gen X.

Key Drivers

E-commerce growth and online shopping trends fuel BNPL adoption.

Increased consumer demand for flexible payment options, especially among younger demographics.

Rising inflation and cost-of-living pressures drive more consumers to seek alternative payment methods.

Market Dynamics

The share of frequent BNPL users is increasing, despite overall adoption growth slowing.

Nearly half of BNPL households earn less than $50,000 per year, indicating its popularity among lower-income groups.

Raw Insights from Fintech Founders

We bring you the latest Fintech scoop, directly from the operational field. NOT from backroom forecast or theory hypothesis.

Orin is at the forefront of technology, bringing cutting-edge AI to Fintech customer service. Helps your business stay ahead of the curve.

Article by

Peter H

Customer Success

Published on

Jan 12, 2025