About Northstar

Northstar is a financial advisory platform for small businesses to navigate accounting and tax compliance requirements. The platform streamlines business accounting, tax planning, and bookkeeping for firms across the United States.

Challenge

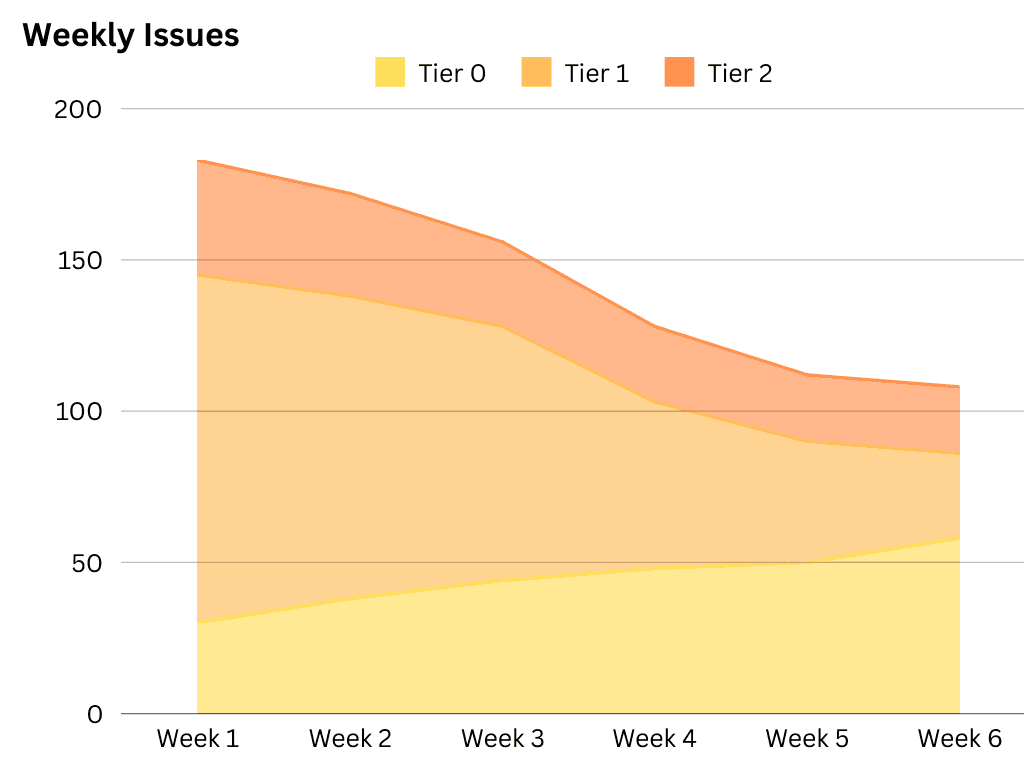

Northstar's support team spent countless hours looking up regulations from 6000+ IRS codes, various forms, and filing deadlines. Their clients fill out lengthy questionnaires during onboarding, which involve uploading documents and verifying facts.

They needed to speed up these time-consuming processes while maintaining accuracy and compliance standards.

Manual lookups and form-filling created bottlenecks in their workflow and limited how many clients they could serve effectively.

Result

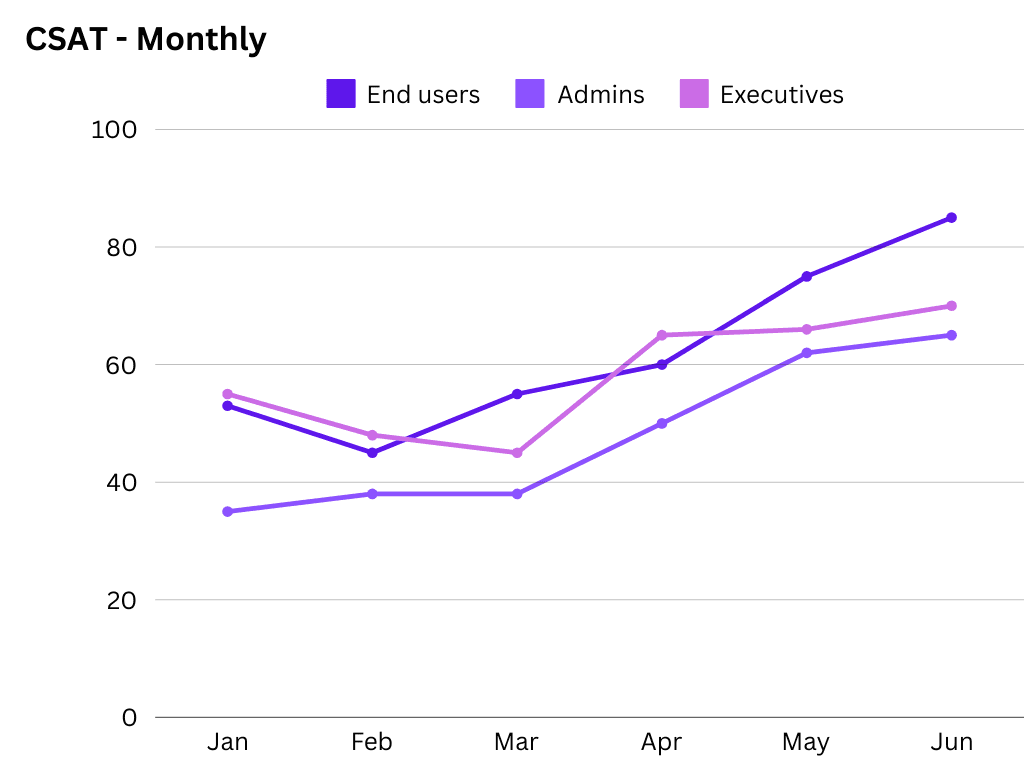

Orin’s AI agent with pre-loaded IRS codes and forms helped Northstar avoid extensive tax document lookups as well as suggest follow-up form actions.

Customized onboarding was enabled based on the client profile and stage.

The Northstar team gets AI assistance in tax inquiries, form details, and onboarding, reducing manual work by 60%. Their advisory agents can now focus on providing strategic tax guidance rather than spending time on repetitive lookups.

How it Started

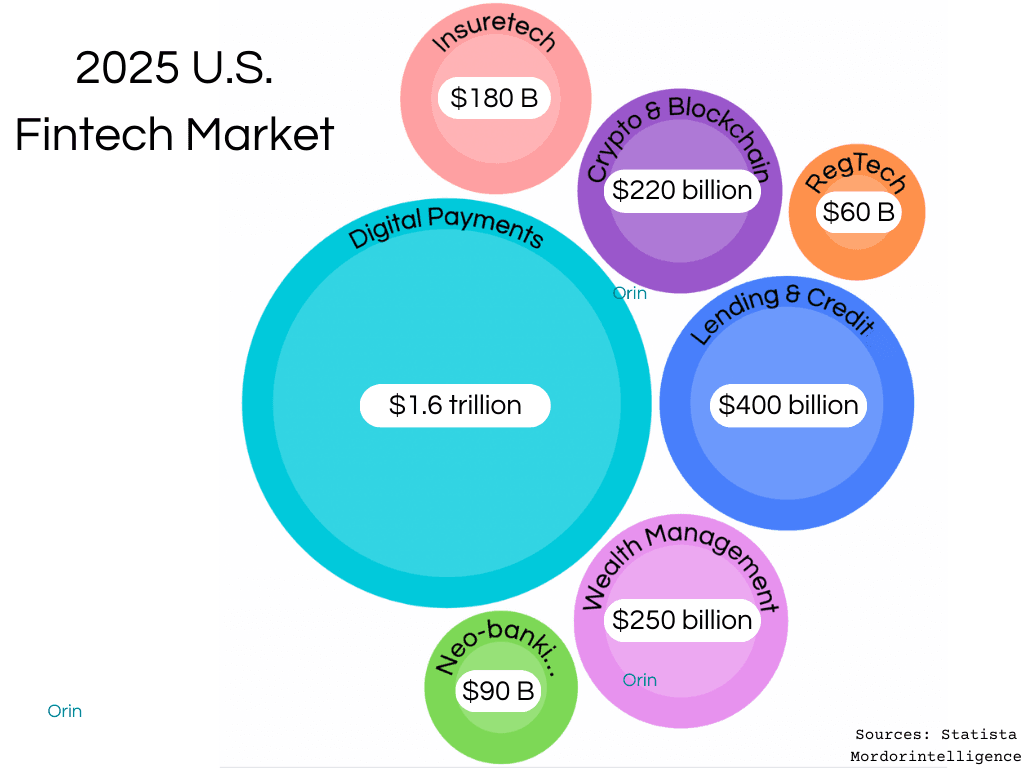

As a veteran tax advisor, Mike Sosinski knew that traditional tax advisory services needed a Fintech digital transformation.

The challenge? The existing support process and software stack were too rigid.

Having their reps manually search through IRS codes and filling out lengthy client questionnaires was incredibly time-consuming and prone to human error.

Before Orin, Northstar's team juggled multiple systems – Federal and state tax codes, internal documents, client forms, and questionnaire tools.

Advisors and support reps spent hours each day just looking up specific tax codes and manually transferring information between systems. Despite their expertise, each advisor could only handle a limited number of clients due to these administrative burdens.

Even when clients had similar tax situations, advisors still had to go through the entire lookup process each time.

To make matters worse, the tax code's complexity meant that even experienced advisors needed to double-check their work constantly, further slowing down the process.

After exploring various automation tools and standalone solutions, Mike decided to trial Orin. Within two weeks, the results were clear – Northstar's team was handling more clients with greater accuracy and spending more time on valuable advisory work.

Why Northstar Chose Orin

Mike focused on finding a solution that could address three critical challenges: accurate tax code lookups, efficient client onboarding, and seamless information management.

Automated tax code lookups:

Orin's AI comes pre-built with all IRS tax codes, and forms information and can instantly retrieve relevant sections and interpretations. This turned hours of manual research into seconds of automated searching.

Streamlined onboarding:

The AI intelligently tunes to each client profile and their stage. Hand-holding them during the form filling and questionnaire completion. Also, nudge on missing documents and verification steps.

This dramatically reduced the time needed to bring on new clients.

Smart information management:

With all of the client tickets, AI bot, tax info, and feedback forms in one system, the team could easily access and share information, making collaboration effortless.

Achieving Results: The Impact

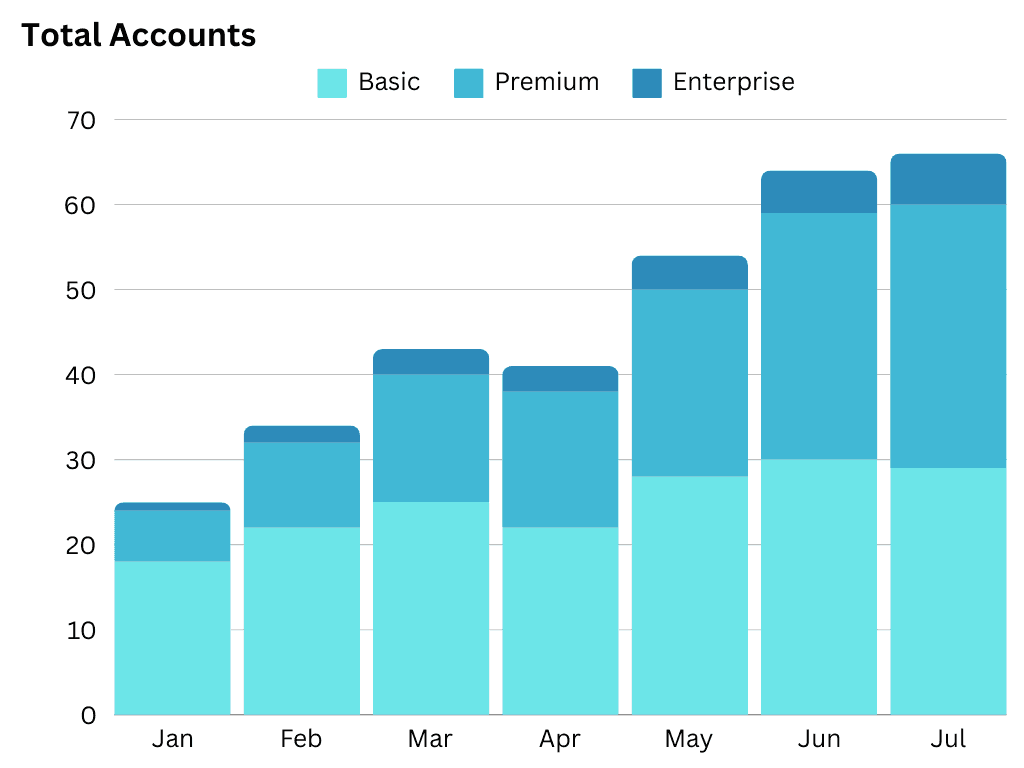

After implementing Orin, Northstar saw immediate improvements in its operations.

The AI agents now handle over 6,000 different IRS code lookups automatically, saving hundreds of hours of manual work. Client onboarding time dropped by 60%, and advisors can now focus on providing strategic guidance instead of filling out forms.

Beyond the numbers, Orin transformed how Northstar's team works. Advisors now spend more time building client relationships and developing tax strategies, rather than getting bogged down in administrative tasks.

For Mike, these results weren't just about efficiency – they represented a fundamental shift in how modern tax advisory services could operate.

Proving that AI could handle the complex world of fintech regulation while enabling human experts to focus on higher-value work.

Article by

Peter H

Customer Success

Published on

Jan 3, 2025