About Paycool

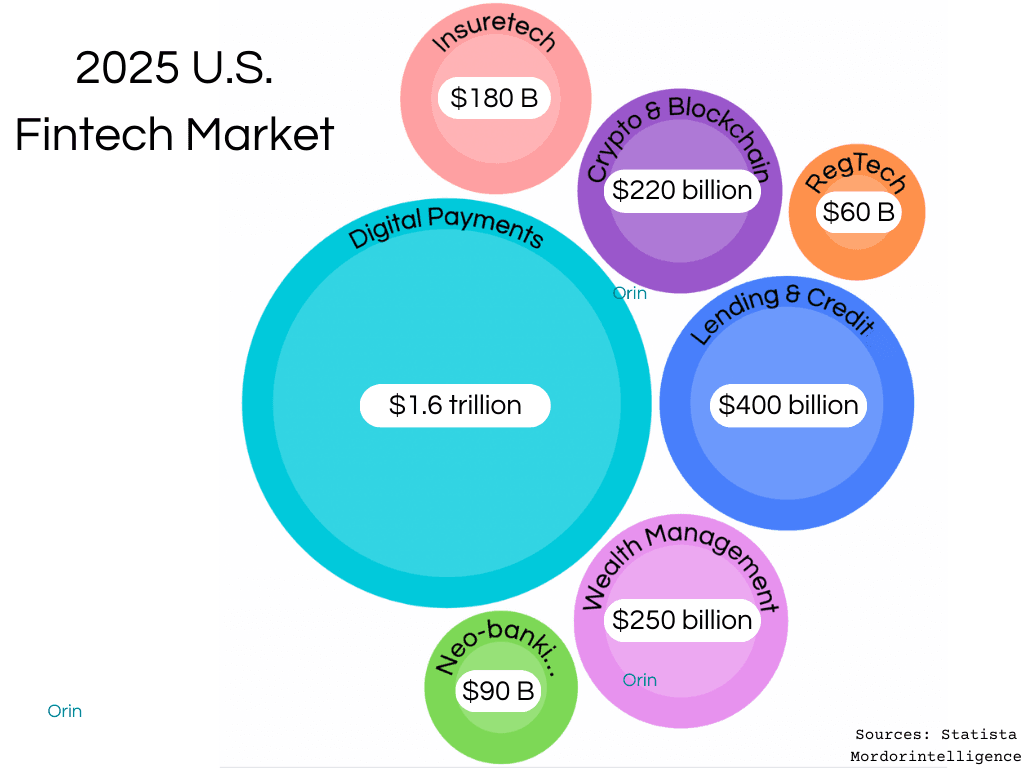

Paycool is a payment platform offering a referral-based profit-sharing model. It supports merchants and consumers in North America, Europe, and Latin America markets.

The platform provides a comprehensive suite of solutions, including a digital wallet, different cryptocurrencies, multi-language capabilities, and operations across web and mobile apps.

Challenge

As Paycool grew its customer base from the initial U.S. to LATAM and Europe markets. The team began receiving a lot of tickets from different time zones and languages.

They needed to maintain the best possible customer experience while keeping a fixed number of support reps. The company wanted to 'do more with less' without outsourcing customer service or hiring across geographies.

Result

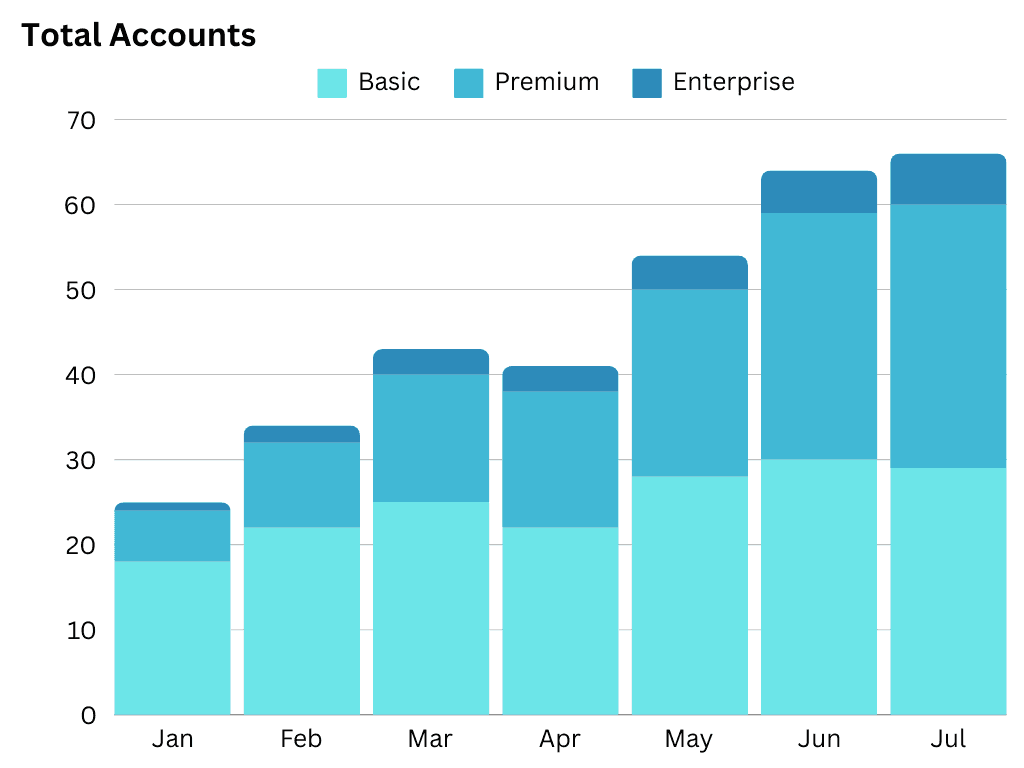

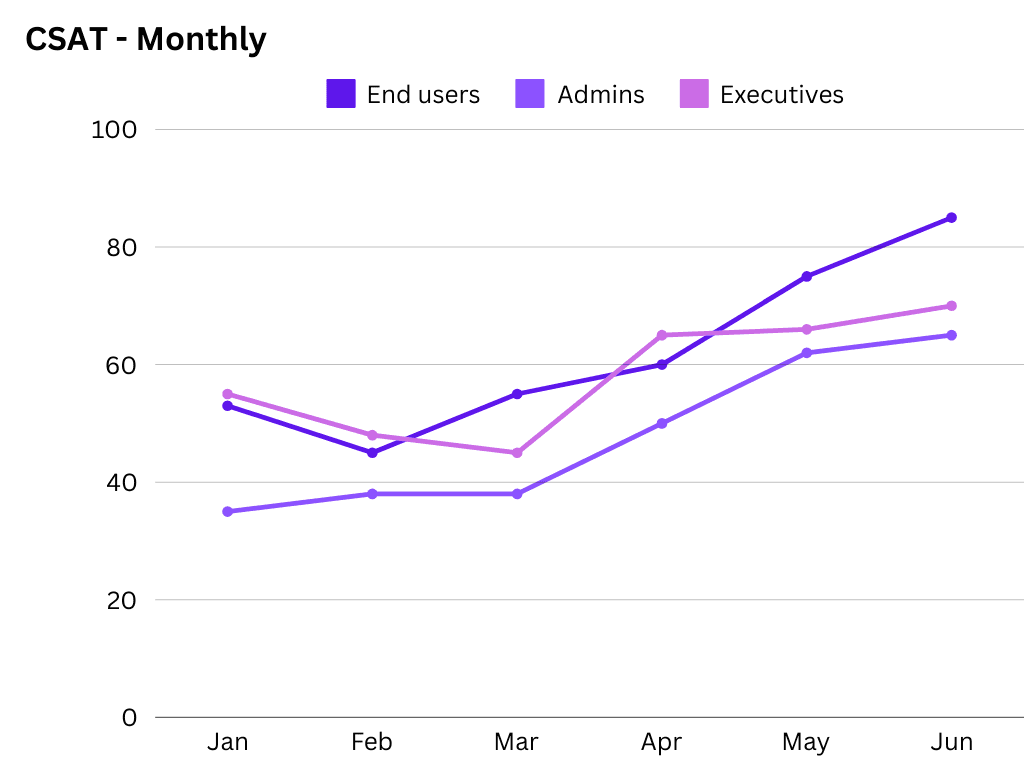

The team is able to provide 24/7 first-level support across different regions. Over 40% of customer requests are handled by Orin AI bots with multi-lingual modes, keeping a consistent answer quality.

Support reps now engage in quality customer conversations about product adoption and team usage.

How it Started

As an experienced Fintech executive, Dora Tang was confident that their payment platform could scale to global customers. The problem? Their existing customer support stack was clunky making it difficult to grow without expensive manual operations.

Before Orin, Paycool’s team used three different systems – a ticketing tool, old chatbot, and feedback surveys set up for each support tier and product suite.

Repetitive manual tasks dragged down their support response, and the constant lookups left reps exhausted before they could engage in meaningful customer conversation.

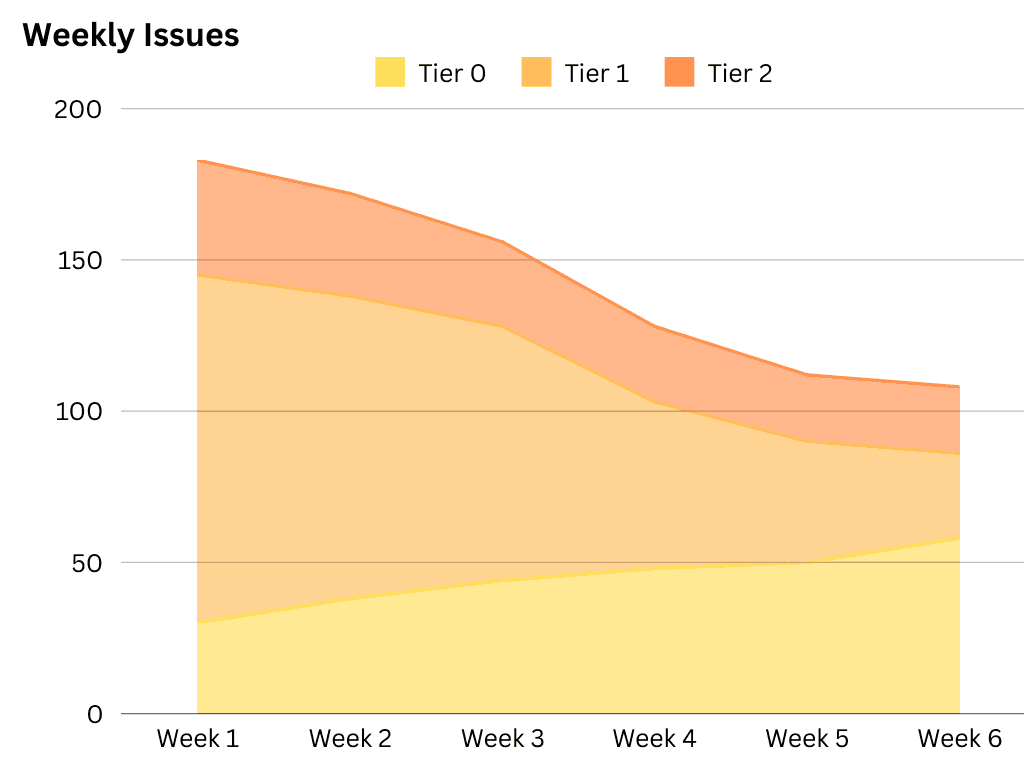

Despite looking into 80 tickets a day, each rep was averaging just over 45 resolutions. Even when half of customer inquiries had a common theme, the system didn’t make use of this language pattern, escalating most questions for human response.

To make matters worse, adding customers in different time zones and languages made it nearly impossible to scale without hiring new reps. And a risk of poor customer experience due to agent onboarding, and stitching more support tools.

After exploring a range of support systems and standalone chatbots, Dora decided to start a trial with Orin. After just one week with the platform, the results were conspicuous – Paycool’s support team was more resourceful, productive, and connected to their customers than ever.

Why Paycool Went with Orin

In evaluating a full-stack support system, Dora prioritized tools that could solve her team’s biggest challenges: effective deflection, long resolution times, and easy team collaboration.

Effective deflection:

Fintech-trained AI agents are productive from day 2 of deployment. Answering most level-one queries about crypto payments and transactions. With round-the-clock operation and multi-language support, scaling to world audiences was a reality.

Long resolution times:

Orin’s ticketing system comes with a built-in AI assistant, suggests relevant documents/articles, and prepares responses for support rep review. This drastically reduces customer issue resolution time.

Easy team collaboration:

With a single stack for AI bot, support tickets, feedback survey, and knowledge base, it’s easy for the entire team to access things and share them easily.

Achieving Results: The Epic ROI

Shortly after implementing Orin, Paycool’s team experienced a promising transformation.

Ticket deflection rates skyrocketed, with over 40% of the first-level issues resolved through AI. Orin’s agentic actions handled smaller customer workflows sparing the human reps of any menial tasks. This allowed the team to engage with customers more meaningfully for better adoption and retention.

Beyond the numbers, Orin made remote collaboration seamless for Paycool's international customer base. Easier navigation of the help center, feedback, reports, and human reps made their customer experience a smooth ride.

For Dora, the results weren’t just in metrics — they were transformative, showing that the right tools can unlock both performance and team potential.

Article by

Peter H

Customer Success

Published on

Dec 30, 2024