Introduction

AI Agents are rapidly transforming Fintech workflows. They’re helping businesses automate tasks, improve efficiency, and enhance customer experiences.

From handling customer service to streamlining compliance, AI Agents are becoming an essential tool for fintech companies.

This cheat sheet provides a quick overview of how AI Agents fit into finance workflows, business functions, security compliance, and deployment models.

Improving Finance Workflows with AI Agents

AI Agents simplify and automate essential financial processes, including:

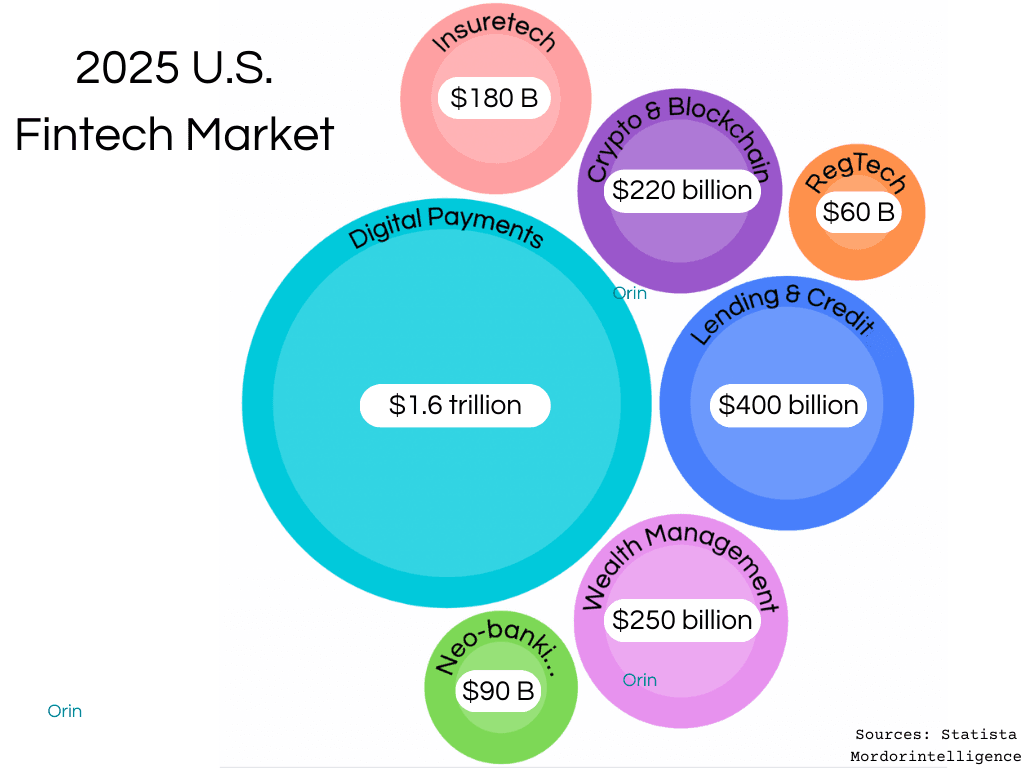

Digital Payments – Automating transactions across different payment processors, optimizing rates, reducing transaction times, and managing currency exchanges.

Loan Assessment – Speeding up risk analysis, due diligence, and approvals using AI-driven risk assessment.

Spend Management – Tracking expenses, monitoring spending patterns, and optimizing budgets for both personal and corporate cards.

Credit Risk – Evaluating borrower profiles, suggesting the right financial products, and minimizing default risks.

Tax Accounting and Audit – Automating invoice follow-ups, managing collections, and ensuring regulatory compliance.

Cryptocurrency – Facilitating the use of stablecoins and Bitcoin for transactions, exchanges, and payments while enhancing user experience.

Business Functions to Support with AI Agents

AI Agents go beyond automation—they actively help fintech companies scale and grow:

Sales & Partnerships – AI-driven insights help sales teams close deals faster.

Customer Service – AI Agents handle customer queries 24/7, reducing the workload for human support teams.

Marketing – AI enables personalized customer engagement based on data-driven insights.

Product Development – Automating data analysis and generating reports to improve product innovation.

API Integrations – Connecting with various fintech platforms to create seamless experiences.

Legal & HR – Automating contract reviews, compliance checks, and employee inquiries.

AI-Agentic Patterns

AI Agents use different operational models to deliver results effectively:

Validator Pattern – AI verifies information before processing.

Task Splitter Pattern – Divides complex tasks for faster execution.

Human-in-the-loop Pattern – Keeps human oversight where needed for sensitive decisions.

RAG Pattern – AI retrieves and generates relevant responses for queries.

Delegation Pattern – AI assigns tasks to different specialized systems for better efficiency.

AI Agent Deployment Models

Businesses can integrate AI Agents in different ways based on their needs:

Auto-pilot in Customer Portals – AI works independently to assist customers, resolve queries, and handle basic workflows.

Co-pilot (Human Assist) – AI works alongside human teams, handling background tasks during live customer interactions.

Cascaded Agent Workflows – Multiple AI Agents working together to manage complex workflows, ideal for banking and financial operations.

API Mode (A2A) – AI connects and interacts with other apps and AI systems to automate processes.

Base Models for AI Agents

Several AI models are commonly used to power fintech AI Agents:

GPT-4o – Best for defining and prompting AI workflows, offering advanced language processing.

Deepseek-R1 – A cost-effective alternative to GPT-4o, with strong reasoning capabilities for financial tasks.

Claude 3.5 Sonnet – Ideal for handling data security, compliance, and logical workflows in fintech applications.

Llama 3.1 – Used for developing specific niche AI use cases in fintech.

Tools to Use for Fintech AI

Some of the best tools for integrating AI into fintech solutions include:

PLAID – Provides financial data connectivity and account verification.

Orin – AI Agent Store with 80+ pre-built Fintech Agents for various use cases, ready for instant deployment.

OpenAI GPT-4o – A leading AI language model for building and managing AI-driven workflows.

Next.js & Vercel – Helps build, manage, and deploy fintech applications efficiently.

Security & Compliance in AI for Fintech

Security is a top priority in fintech, and AI helps businesses stay compliant while reducing risks:

KYC & KYB – AI-powered identity verification to prevent fraud and ensure compliance.

SOC-2, GDPR – All the AI-Agents deployed need to meet strict data privacy and security standards.

AML & Fraud Detection – Real-time monitoring of transactions to detect suspicious activities.

PCI DSS – Ensuring secure credit card transactions and protecting customer data.

Final Thoughts

AI Agents are reshaping the fintech industry by reducing costs, improving efficiency, and automating critical tasks. Whether it’s customer support, security compliance, or financial workflows, AI is driving the next big evolution in financial services.

Are you considering AI for your fintech business?

Let’s explore how AI Agents can accelerate your growth! 🚀

Article by

Peter H

Customer Success

Published on

Feb 11, 2025