Fintech for Startups: Essential ToolKit

From Starting to Growing

Founding a company is exciting, and one thing is managing the financial side starts from Day 1.

It can get overwhelming as your team, customers and funding grows. Lot of tool choices, options to select and ways to operate.

It’s tricky to know what’s real deal - with many promotions, pricing plans and hidden fees around.

After exploring and testing, here’s a breakdown of the fintech stack that’s been essential for us:

1. Incorporating

First things first — getting the company set up legally.

Services like Atlas, Clerky, Doola, and Every make it easy to register your business, handle ownership structures, and stay compliant.

2. Fundraising

Managing our cap table and 409A valuations could have been a nightmare, but tools like Carta, Pulley, and Cake Equity simplify equity tracking and SAFE financing.

If you’re raising money, one of these tools is essential.

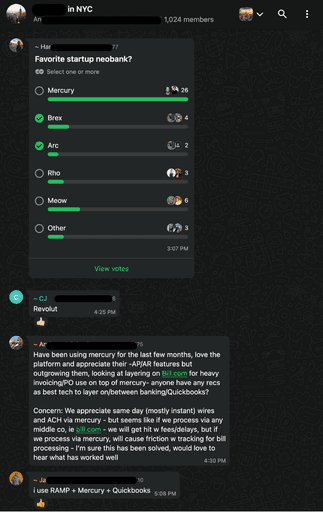

3. Core Banking

You need a business bank account to handle money transfers, deposits, and loans.

We've a no-fluff comparison of banks for startups (linked in the Full Comparison List) to help pick the best one for your case.

4. Tax Accounting

Bookkeeping, tax filing, and financial planning can get messy.

Startups usually find Xero, QuickBooks, Zeni, Digits, Pilot, and Bench type of tools to help keep everything in check.

5. Managing Expenses

Keeping track of company spending, paying receipts, and issuing corporate cards is crucial.

Ramp, Brex, Bills, and Expensify help automate expense tracking, and approvals.

6. Managing Subscriptions

We rely on multiple SaaS tools, and keeping track of invoices, billing and payment processing is essential. Some of them handle even CPQs.

Platforms like Stripe, Adyen, Finix, and Chargebee make this process seamless.

7. Payroll & People Management

Once we started hiring, we needed a system to handle salaries, time tracking, and tax deductions.

Rippling, Gusto, Deel, and JustWorks have been great options for startups.

8. Data Privacy Compliance

Security and compliance are huge, especially with SOC2, GDPR, HIPAA, and PCI requirements.

Vanta, Sprinto, Drata, and Secureframe help companies meet these standards without the headache.

Why This Matters Now

As a startup, every early decision matters. People you deal with and toolstack you work with.

A wrong fintech tools can lead to lost time, wasted efforts, compliance headaches, or even funding issues. What has worked for us is the ones suggested by word-of-mouth by fellow operators.

Having right tool can save you time, automate ton of tasks, and help you stay focused on building your actual business.

Final Thoughts

This is a high level Fintech stack. So far we're written one in-depth comparison about Banks for Startups - https://useorin.com/fintech-picks

Whitle we’re still refining this stack, but this has been a solid starting point. If you're in the early stages of your startup journey, I hope this list helps!

Would love to hear from other founders, startup operators — What’s been your best or worst Fintech experience?

Drop a comment with Orin AI Agent! 🚀

References:

Real conversations compiled from people inputs through Orin AI-Agent

https://www.reddit.com/r/fintech/

https://www.g2.com/

https://www.reddit.com/r/SaaS/

How Orin is Changing Customer Support

Real stories of how Orin is helping Fintech teams improve their customer operations