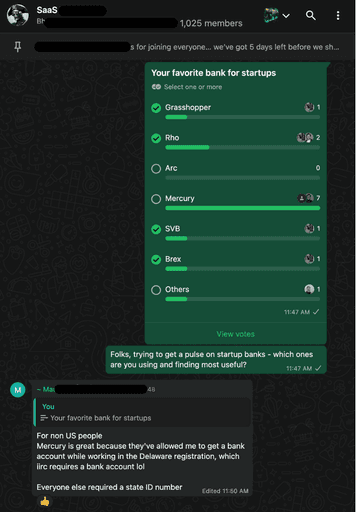

Community Polls & Voices - Fall 2025

Some key factors to consider

1. Branch Access & Customer Support

Some banks, like SVB and Citizens Private Bank, have physical branch offices, while most online-focused banks do not.

Brex, Relay, and Grasshopper offer 24/7 or extended customer service, which can be useful when handling urgent financial needs.

2. Accounting & Bookkeeping Integrations

Many banks support direct integration with QuickBooks, Xero, and other accounting software.

Relay, Brex, and Mercury make it easy to sync transactions, reducing manual data entry.

Brex offers automated categorization of expenses, making bookkeeping even easier for startups.

3. ATM Access & Deposits

SVB, Novo, and Relay allow ATM deposits, with Novo even offering refunds on fees.

Many others, such as Mercury and Rho, do not support ATM deposits.

4. Corporate Credit Cards & Spend Management

If your startup needs a corporate credit card, Mercury, Brex, and Grasshopper offer them.

Some banks also provide built-in spend management tools to track and control company expenses.

Brex and Relay stand out for offering real-time spend tracking and virtual cards for team members.

5. Wire Transfer Fees

Free domestic and international transfers are available with Mercury, Brex, Rho, Arc, and Grasshopper.

Other banks charge fees, such as SVB ($10 per domestic transfer) and Relay ($30 per domestic transfer).

6. FDIC Insurance & APY (Interest on Deposits)

Most banks insure deposits up to $250K, but some, like LiveOak ($10M) and Brex ($6M), offer higher coverage.

If earning interest on deposits matters, Mercury, Brex, SVB, Arc, and LiveOak offer APYs above 3.5%, while others have lower or variable rates.

7. Overdraft Fees

Some banks charge fees for overdrafts, like SVB ($30) and Citizens Private Bank ($120 max total), while others, like Mercury, Brex, and Rho, do not.

8. Accounts Receivable & Payable Support

Managing cash flow is critical, and some banks help automate receivables and payables.

Relay and Grasshopper offer AP (accounts payable) automation, making it easier to pay vendors.

SVB and First Republic provide financing options like lines of credit and venture debt for managing cash flow.

9. Other Services

Different banks offer additional perks. Relay supports AP processing and expense management, while Brex focuses on VC-backed startups.

Citizens Private Bank has a California focus, and LiveOak provides SBA loan options.

Novo and Mercury offer business analytics tools to track financial performance.

Which Bank is Right for Your Startup?

The best choice depends on your startup’s needs:

For VC-backed startups: Brex is tailored for venture-backed companies with special perks.

For high FDIC insurance: LiveOak and Brex offer multi-million dollar coverage.

For free wire transfers: Mercury, Brex, Rho, and Arc are strong options.

For in-person banking: SVB and First Republic provide physical branch access.

For bookkeeping & accounting automation: Relay, Mercury, and Brex integrate well with QuickBooks and Xero.

For spend control & virtual cards: Brex and Relay offer built-in tools for managing team expenses.

Final Thoughts

Picking the right bank can save your startup money and help with smoother financial management. Consider what matters most—support, fees, credit cards, integrations, or additional services—and choose the one that fits your needs best.

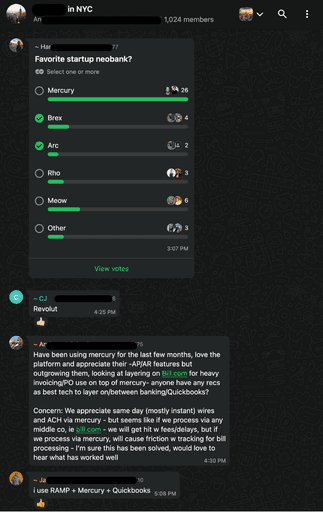

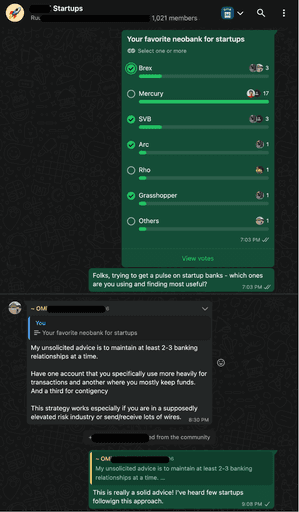

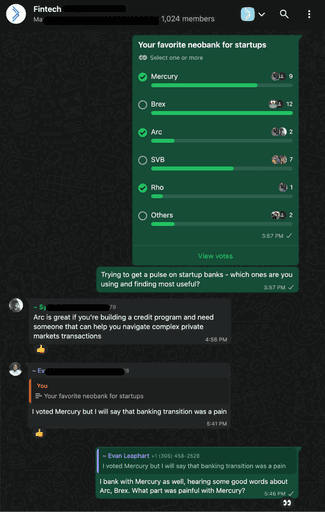

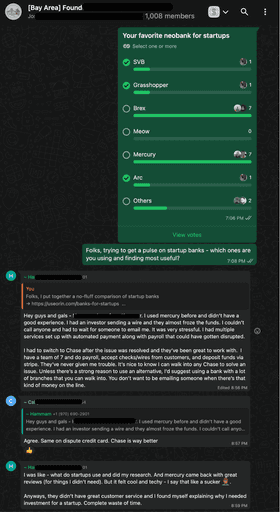

Would love to hear from other founders—what’s been your best banking experience?

Drop a comment with our AI Agent! 🚀

References:

https://www.ecaplabs.com/blogs/11-best-banks-startups

https://kruzeconsulting.com/best-business-banks/

https://www.nerdwallet.com/best/small-business/banks-for-startups

Fintech apps increase capital flow with Orin

Real stories of how Orin is helping

fintech teams decrease user drop-off rates to other platforms